The drive home from Laramie hits different when you've left your youngest there in her new dorm room.

After nineteen years of constant chatter—what we lovingly called "chatterboxing" when she wouldn't stop talking as a kid—the silence in the car feels almost physical. Three daughters launched. Zero left at home (I say “zero” because we only see the one who lives in the basement when she’s hungry). Just me, Michelle, and a suspiciously quiet house that somehow still manages to accumulate dishes in the sink.

Every Empty Nest Has Its Own Lint

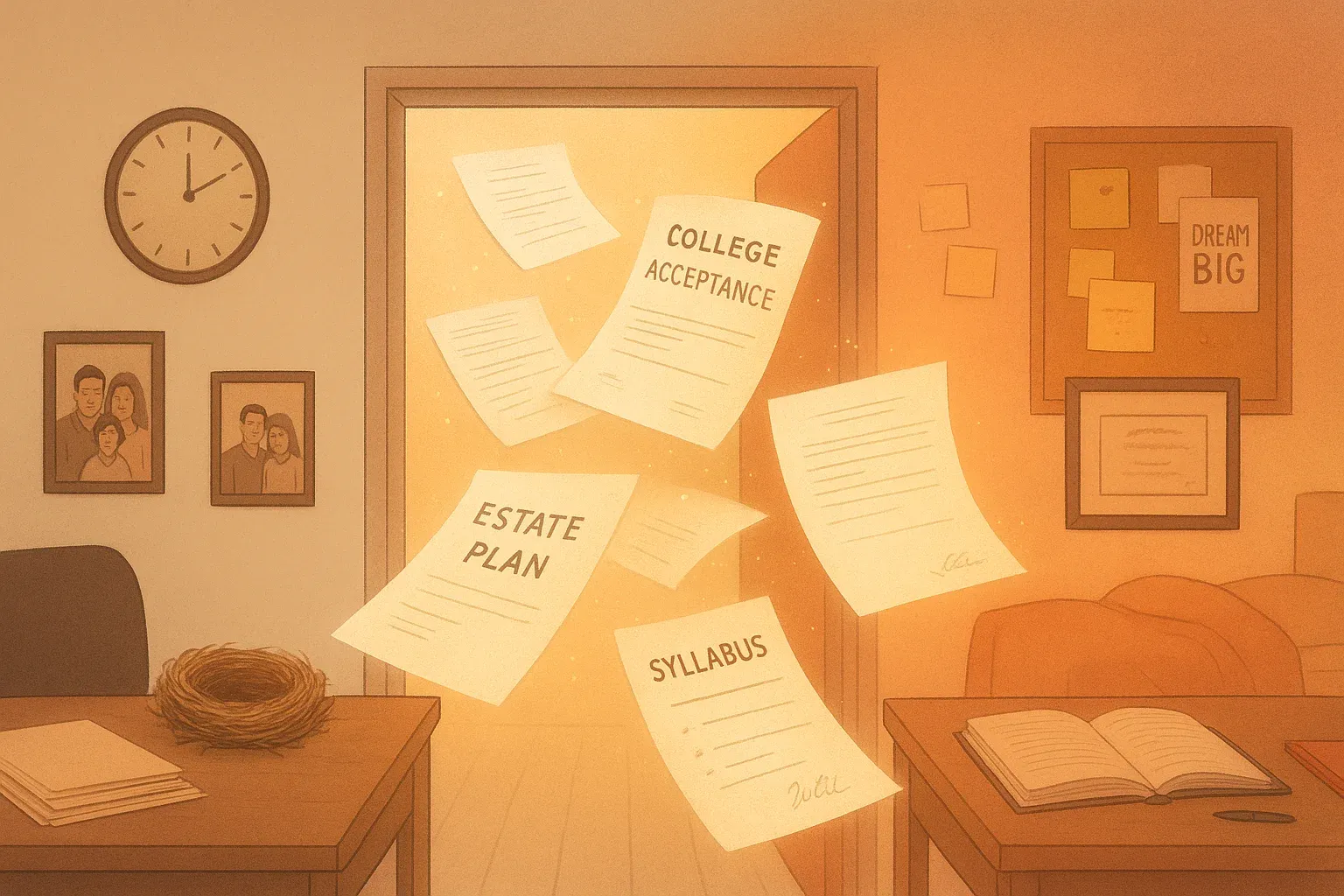

Here's where the Belly-Button Principle kicks in: every family's college drop-off experience is as unique as, well, their belly buttons. Your kid's journey to independence is theirs alone, irreplaceably individual. But here's the thing—that journey doesn't happen in isolation. It ripples through the entire family system, revealing gaps in your legal scaffolding you didn't know existed.

Some parents discover this when they're frantically trying to access their kid's medical information during a 2 AM emergency call. Others figure it out when they can't help with a financial aid snafu because they're locked out of every system. We learned it during a health scare in March when our youngest had seizure-like episodes (she’s fine now). Nothing like a medical crisis to make you realize your "baby" is legally an adult who needs her own healthcare directives.

The "Always Documents" Nobody Thinks About Until They Do

At 19, your kid is legally an adult. Full stop. Doesn't matter that they still call you to ask which setting to use on the washing machine. The law sees them as a fully autonomous human being with all the privacy rights that entails.

This is where what I call the "Always Documents" come in—healthcare directives and financial powers of attorney. I make all my kids do them. Yes, even the one who insists she's "totally fine" and "nothing's going to happen." Because here's the uncomfortable truth: something already did happen to us, and having those documents made all the difference when we needed to coordinate her care.

These aren't death documents. They're life documents. They're "I need mom and dad to help me navigate this medical situation" documents. They're "I'm studying abroad and need someone to handle this financial issue" documents. They're peace of mind wrapped in legal language.

The Great Parental Identity Crisis of Junior Year

Watching Michelle prepare for our youngest's departure was like watching someone plan for their own moon landing. Spreadsheets. Lists. Color-coded storage solutions. At several points, I had to gently remind her that "we aren't going to college. She is."

But that's the thing about transitions—they force us to audit more than just dorm room supplies. When your role shifts from active parent to... whatever we're supposed to be now... it's time to look at everything with fresh eyes. Estate planning included.

Because here's what empty nesters discover: your estate plan was built for a different season. The guardianship provisions? Obsolete. The educational trust distributions? Actively happening. The assumption that your kids would be fighting over who has to take care of you? Suddenly less theoretical when they're all launching careers in different states.

The Practical Pivot That Actually Matters

This transition time—when you're adjusting to a quieter house and fewer loads of laundry (we’re still waiting for the laundry load to tail off)—is actually the perfect moment for an estate planning review. Not because you're morbid, but because you're already recalibrating everything else about your life.

Questions worth asking yourself:

- Do your healthcare directives still name the right people? (Is your brother still the best choice, or would your now-adult daughter be better?)

- Are your beneficiary designations current? (That 401k still listing "all children equally" needs specifics now)

- Have you talked to your adult kids about what would happen if something happened to you? (They're old enough for this conversation now)

- Do you have a plan for helping with grandkids' education someday? (I know, I know, but it's worth thinking about)

The beautiful irony is that helping your kids launch successfully requires good legal scaffolding for both generations. They need their "Always Documents" to navigate adulthood. You need updated plans that reflect your new reality as empty nesters.

Building Foundations for the Next Chapter

Here's what two decades of "chatterboxing" taught me: the noise never really stops, it just changes frequency. Now instead of constant chatter at the dinner table, it's FaceTime calls about roommate drama and texts asking how to remove red wine stains. (Pro tip: club soda, immediately.)

The legal foundations we build aren't just about protecting assets or avoiding probate. They're about creating structures that support our families through every transition—from first days of kindergarten to last drives to college, from chatterbox toddlers to independent adults who still need their parents, just differently.

Your empty nest might feel empty, but it's not abandoned. It's evolved. Make sure your legal planning has evolved with it.

Ready to update your estate plan for this new chapter? Whether you're sending your first kid to college or your last, we can help you build the legal foundations that support your family's next phase. Because every family's journey—like every belly button—is unique, but the need for solid legal planning is universal.

This article is a service of The Law Offices of Owen Hathaway, a Personal Family Lawyer® Firm. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That's why we offer a Family Wealth Planning Session™, during which you will get more financially organized than you’ve ever been before and make all the best choices for the people you love. You can begin by calling our office today to schedule a Family Wealth Planning Session.

The content is sourced from Personal Family Lawyer® for use by Personal Family Lawyer® firms, a source believed to be providing accurate information. This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking legal advice specific to your needs, such advice services must be obtained on your own separate from this educational material.